Nebraska’s Caregiver Tax Credit

Support is finally on the way for Nebraska’s 179,000 family caregivers and the parents, spouses, and other loved ones they care for with a tax credit provided by the Caregiver Tax Credit Act. The Caregiver Tax Credit Act passed during the 2024 Nebraska legislative session and will take effect on January 1, 2025, and become available for the 2025 tax year. Passage of the tax credit now makes Nebraska the second state in the nation to adopt an expansive tax credit for family caregivers.

The Caregiver Tax Credit Act provides a nonrefundable tax credit for out-of-pocket costs incurred by the unpaid family caregiver for a limited set of services. The expenses must be directly related to assisting the family caregiver in providing care to an eligible family member. The tax credit is capped at $2,000 per year for most participants. Individuals caring for veterans or those with a dementia-related diagnosis will receive up to a $3,000 tax credit. There are no age restrictions to qualify for the tax credit.

Join us for to learn more about the credit as well as resources and tools available to caregivers to assist in determining eligibility and information and resources available to caregivers across the state.

Your feedback in valuable! Please let us know what you thought of this session. A certificate of completion is available upon submitting of feedback. Be sure to type in your name and then you can download or print the certificate.

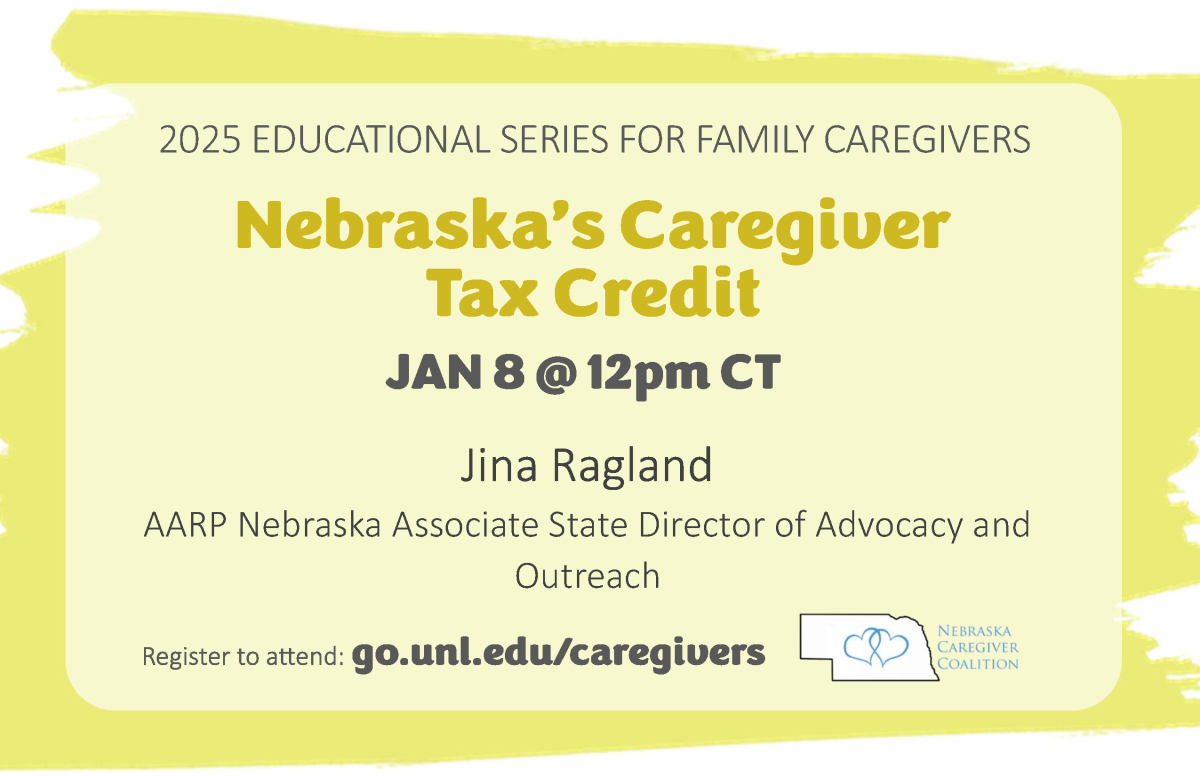

Presented January 8, 2025

Presented by Jina Ragland, AARP Nebraska Associate State Director of Advocacy and Outreach

Jina Ragland is the Associate State Director of Advocacy and Outreach for AARP NE. In her role, Jina oversees the advocacy agenda for the Nebraska state office and works closely with state and federal elected officials to promote, pass and enhance laws that assist Nebraskans 50 and older and their families to age in place.

Jina Ragland is the Associate State Director of Advocacy and Outreach for AARP NE. In her role, Jina oversees the advocacy agenda for the Nebraska state office and works closely with state and federal elected officials to promote, pass and enhance laws that assist Nebraskans 50 and older and their families to age in place.

Prior to joining AARP NE, Ms. Ragland was the Vice President of Advocacy and Regulation with the Nebraska Medical Association for ten years. While there she was involved in the management and oversight of the physician specialty society organizations and was promoted to direct and implement the NMA’s legislative agenda through legislation to promote the health, safety, and overall well-being for all Nebraskans. Before serving the NMA, Ms. Ragland was the State Director of the Nebraska Senior Health Insurance Information Program (SHIIP) with the Nebraska Department of Insurance. She was charged with leading the roll-out of the Medicare Part D program across the state of Nebraska when the program began in 2006. She assisted the state of Nebraska to 92% of Medicare beneficiaries being enrolled while being recognized by the Centers for Medicare and Medicaid as 4th in the nation.

In her current role at AARP, Ms. Ragland is actively involved in Legislative issues affecting Nebraskans 50+ and their families, navigating regulations and laws to ensure that all Nebraskans have the voice and ability to successfully age in place. Jina was recently awarded the “Professional of the Year” Award by the Nebraska Coalition for Older Adult Health Promotion as well as named the recipient of AARP’s highest advocacy achievement award, “The Lyn Bodiford Award for Excellence in Advocacy,” for her advocacy work to successfully eliminate the full taxation on Social Security Benefits as well as successfully pass the nation’s first most comprehensive state caregiver tax credit.

Jina actively volunteers with the Nebraska SHIP, the Tabitha Meals on Wheels Program, serves as a Lancaster County Poll Worker, and is the Merchandise Chair for her son’s Parent Teacher Organization.

This session is part of the Education Series for the Family Caregiver, hosted by The Nebraska Caregiver Coalition.